Updated Policy Announced for Asaan Karobar Card Distribution October 2025 – Latest News

Updated Policy Announced for Asaan Karobar Card Distribution October 2025 by the Government of Pakistan. The government has recently introduced a revised framework for the Asaan Karobar Card distribution, a scheme that has been central to business facilitation efforts over the past few years. This updated policy marks a significant step toward making finance more accessible to a broader segment of society, particularly small and medium enterprises (SMEs), shopkeepers, and emerging entrepreneurs. The initiative aims not only to offer financial support but also to promote economic stability, job creation, and long-term business sustainability.

The revised initiative is part of a broader framework of government financial assistance programs that aim to strengthen the local economy. By providing an easy-to-access small business financing card, the government has ensured that micro and medium enterprises, often neglected in traditional banking systems, can now secure capital without facing overwhelming obstacles. This reflects a shift in policy thinking, where entrepreneurship is considered a key driver of national development.

Another major highlight of the business support card scheme is the simplification of procedures. Entrepreneurs and traders can now take advantage of a business card registration process that reduces paperwork, minimizes red tape, and speeds up approval times. The updated system also incorporates digital business support initiatives, making applications smoother and more transparent. For many small traders and startups, these reforms will help reduce the financial anxiety that often comes with limited funding options.

Equally important is the focus on inclusivity. The Aasan Karobar Card eligibility criteria have been broadened so that both new startups and existing businesses can apply. Women entrepreneurs, in particular, stand to benefit from the inclusive financial support programs attached to this scheme, enabling them to start and expand businesses in competitive markets. This inclusive approach makes the policy more than just a financial tool; it is also a step toward social empowerment.

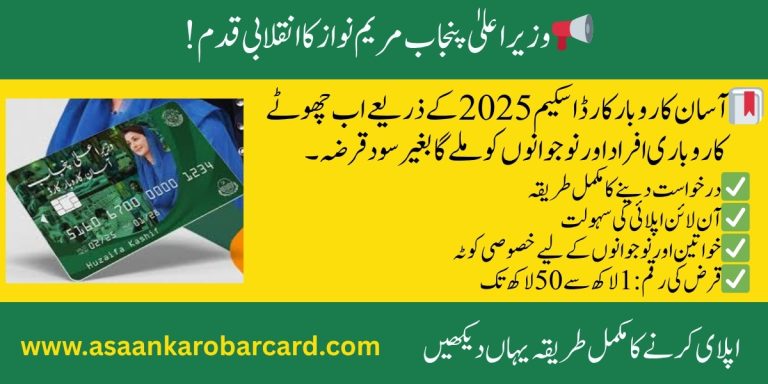

What is the Aasan Karobar Card

The Aasan Karobar Card was introduced as part of the government business facilitation card initiatives aimed at strengthening entrepreneurship and creating job opportunities. Initially, the scheme had strict requirements for applicants, which made it difficult for many small traders and startups to qualify. The updated distribution policy now ensures that businesses with limited resources can also gain access to funding without facing unnecessary hurdles.

This initiative falls under broader government financial assistance programs that are focused on improving Pakistan’s ease of doing business and supporting small and medium enterprises (SMEs) support. By offering credit facilities to both existing and new businesses, the government is encouraging entrepreneurship, innovation, and local economic growth.

Why Updated Policy Announced for Asaan Karobar Card Distribution October 2025 Was Necessary

The revision of the policy was influenced by several important factors:

- Access to Credit for Small Businesses

Many startups and micro-enterprises lacked collateral to secure financing. With updated rules, they can now apply for loans with little to no equity contribution. - Encouraging Entrepreneurship

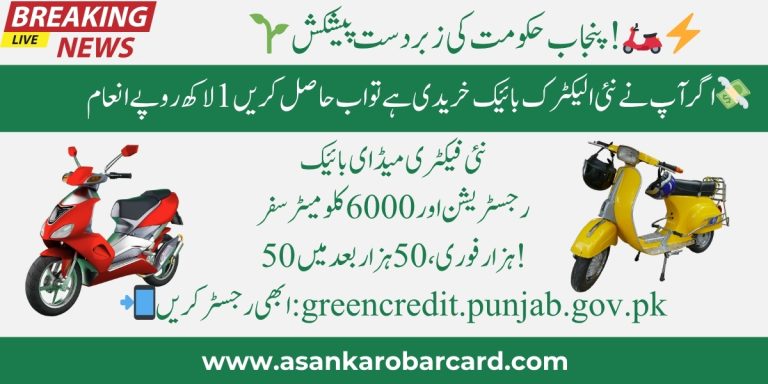

Pakistan has a large youth population with entrepreneurial ambitions. The entrepreneurship support program embedded in the new policy is intended to empower young people to create sustainable livelihoods. - Boosting Economic Growth

SMEs are the backbone of the economy. Through easy loan schemes for entrepreneurs, the government hopes to stimulate job creation, increase production, and enhance overall competitiveness. - Simplifying Bureaucracy

The new policy introduces a business card registration process that reduces paperwork, speeds up verification, and embraces digital channels, aligning with digital business support initiatives

Key Changes in the Updated Policy of Asaan Karobar Card

The Updated Policy Announced for Asaan Karobar Card Distribution October 2025 reforms that make financing more accessible, reduce barriers for applicants, and expand opportunities for startups as well as established businesses. Below is a comparison of the old rules versus the revised ones:

| Key Area | Previous Policy | Updated Policy / Revision |

| Equity Contribution / Collateral | Many applicants, especially new businesses, had to provide equity or collateral that was difficult to arrange. | For startups and certain small businesses, the equity requirement has been reduced to 0% or kept minimal, making entry easier. |

| Grace Period | Repayment schedules were rigid, with little or no grace period allowed. | Startups now receive up to 6 months, while existing SMEs get up to 3 months before repayment begins. |

| Eligibility Criteria | Only businesses with prior experience or a certain operational age could apply. | Eligibility has been expanded to include startups, shopkeepers, and youth entrepreneurs with less business history. |

| Fees & Processing Charges | Higher issuance and processing fees discouraged many applicants. | Fees have been standardized and reduced, with processing costs around PKR 500, making the card affordable. |

| Financing Limits | Smaller limits restricted growth opportunities, particularly for medium enterprises. | Financing amounts have been increased, with medium enterprises qualifying for larger loans, in some cases up to Rs. 30 million. |

| Application & Delivery Process | Paper-heavy applications, long waiting times, and delays in card delivery. | Digital business support initiatives introduced: simplified documentation, faster approvals, and digital platforms such as portals and WhatsApp services. |

Eligibility Criteria for Updated Policy Announced for Asaan Karobar Card Distribution October 2025

To benefit from the updated distribution policy, applicants must meet certain criteria:

- Startups: Newly registered businesses or young entrepreneurs can apply without equity contributions.

- Existing SMEs: Enterprises already in operation for at least six months are eligible for financing with flexible grace periods.

- Traders and Shopkeepers: The revised policy expands to cover retail shops and small traders under government schemes for traders and shopkeepers.

- Women Entrepreneurs: The scheme encourages female participation in business by offering special benefits under inclusive financial support programs.

- Medium Enterprises: Larger SMEs can qualify for higher loan amounts to help scale their operations.

Required Documents for the Updated Aasan Karobar Card Policy

To make the application process easier, the government has simplified the list of documents needed for the business card registration process. Applicants no longer need to go through lengthy paperwork. Still, certain documents remain essential to ensure transparency and proper verification. Below is the updated list of documents required under the new policy:

Mandatory Documents for All Applicants

- Computerized National Identity Card (CNIC) – Original and a photocopy for identity verification.

- Passport-sized Photographs – Recent photographs for official records.

- Proof of Residence – Utility bill, rental agreement, or domicile certificate to confirm the business owner’s address.

- Bank Account Details – A valid bank account in the applicant’s name for loan disbursement.

Additional Documents for Existing Businesses

- Business Registration Certificate – For registered enterprises such as sole proprietorships, partnerships, or private limited companies.

- Tax Identification Number (if applicable) – To verify tax compliance.

- Utility Bills of Business Premises – Electricity, gas, or water bills showing business activity.

- Bank Statement (last 6–12 months) – Proof of financial activity and income flow.

Documents for Startups and New Entrepreneurs

- Business Proposal or Plan – A simple outline of the business idea, objectives, and estimated expenses.

- Letter of Recommendation (optional) – From a recognized chamber of commerce, trade body, or professional mentor.

- Training or Certification Documents (if available) – For applicants who have attended business development or entrepreneurship training programs.

Documents for Special Categories (Women and Youth Entrepreneurs)

- Women Applicants – May be asked to provide proof of ownership or partnership in the business.

- Youth Entrepreneurs – Proof of age (below the maximum limit defined in the policy) such as CNIC or birth certificate.

- Special Incentive Applications – Any additional forms required for availing specific incentives offered to marginalized groups.

Updated Asaan Karobar Card Application Process – Step by Steps

The business card registration process is now more user-friendly. Here is a breakdown of how applicants can apply:

- Check Eligibility

Confirm whether you qualify as a startup, existing SME, or medium enterprise. - Gather Documents

Essential documents include a CNIC, business registration certificate (if applicable), bank details, and proof of address. - Online or In-Person Application

Apply through official portals, business facilitation centers, or in some cases via digital platforms. - Pay Processing Fee

A nominal fee of around PKR 500 is charged for processing. - Verification Process

Authorities verify the submitted documents and assess eligibility. - Issuance of Card

Once approved, applicants receive their Aasan Karobar Card, which can be used to access financing under the scheme. - Utilization and Repayment

The card can be used for business-related expenses, with repayment starting after the grace period ends.

The small business financing card now comes with standardized, reduced processing fees, making the program more accessible to low-income traders and shopkeepers.

Benefits of the Updated Aasan Karobar Card Policy

The new policy provides a wide range of benefits:

- Financial Accessibility: Entrepreneurs gain quick access to funds without traditional banking barriers.

- Risk Reduction: Grace periods allow businesses to generate income before repaying.

- Entrepreneurial Growth: Youth and women entrepreneurs can now participate more actively.

- Digital Transformation: The integration of digital business support initiatives reduces paperwork and speeds up the process.

- Economic Uplift: By strengthening SMEs, the scheme directly contributes to national economic stability.

Challenges and Concerns

During Updated Policy Announced for Asaan Karobar Card Distribution October 2025 the improvements, some challenges still need to be addressed:

- Awareness: Many traders in rural areas are not fully aware of how to apply.

- Implementation: Policy rollout may face delays if administrative efficiency is lacking.

- Monitoring: Ensuring funds are used only for business purposes requires strict oversight/

- Digital Divide: Not all applicants have access to smartphones or internet services.

Future Outlook

As the government continues to reform policies, the Aasan Karobar Card is expected to play a major role in promoting entrepreneurship. More digital features will likely be introduced, such as mobile applications and AI-powered credit assessments, to further simplify the process. The focus on inclusive financial support programs will also ensure that marginalized groups are not left behind.

With continuous improvements, the scheme could significantly change the business landscape by providing accessible financing to thousands of SMEs across the country.

Conclusion

The updated policy announced for Aasan Karobar Card distribution is a milestone in Pakistan’s journey toward financial inclusion and SME empowerment. By revising equity contributions, extending grace periods, broadening eligibility, and simplifying the business card registration process, the government has opened new doors for entrepreneurs, shopkeepers, and startups.

The initiative is more than just a business support card scheme; it is a vision for economic growth, innovation, and opportunity. Through government financial assistance programs, easy loan schemes for entrepreneurs, and policy reforms for small business growth, Pakistan is setting the stage for a stronger and more resilient economy. For aspiring entrepreneurs, traders, and SMEs, the Aasan Karobar Card is no longer just a piece of plastic. It represents a chance to start, grow, and sustain a business with the full support of the government.