Asaan Karobar Card Online Portal Sep 2025 akc.punjab.gov.pk

The Asaan Karobar Card is a ground-breaking initiative launched by the Government of Punjab to empower small entrepreneurs and support business growth across the province. Announced under the leadership of Chief Minister Punjab Maryam Nawaz Sharif, this program aims to provide interest-free loans up to PKR 1 million to small and medium-sized enterprises (SMEs), startups, and young entrepreneurs.

Maryam Nawaz Hints at “Asaan Plus”, a Premium Version Coming Soon 2025

October Update: Citizens to Track Subsidy Live Through Asaan App 2025 – Instantly Track

Maryam Nawaz Approves Cashback Points Feature on Asaan Card 2025 – Register Now

Punjab Govt Planning QR-Based Asaan Card for Instant Payments 2025 – Instantly Check

Maryam Nawaz Expands Asaan Card for Senior Citizens Welfare 2025

Deadline Alert! Asaan Karobar Card Gas Bill Relief Deadline – Apply Today

Amount Allocated for the Asaan Karobar Card Program

The Punjab government has made a significant financial commitment to ensure the success of the Asaan Karobar Card scheme. A total of 84 billion rupees has been allocated for the broader business finance initiative, with 48 billion rupees specifically set aside for the Asaan Karobar Card.

This enormous budget reflects the government’s dedication to uplifting small businesses, fostering entrepreneurship, and creating new job opportunities throughout Punjab. The allocation guarantees that thousands of deserving entrepreneurs will have access to the funds needed to establish or expand their businesses.

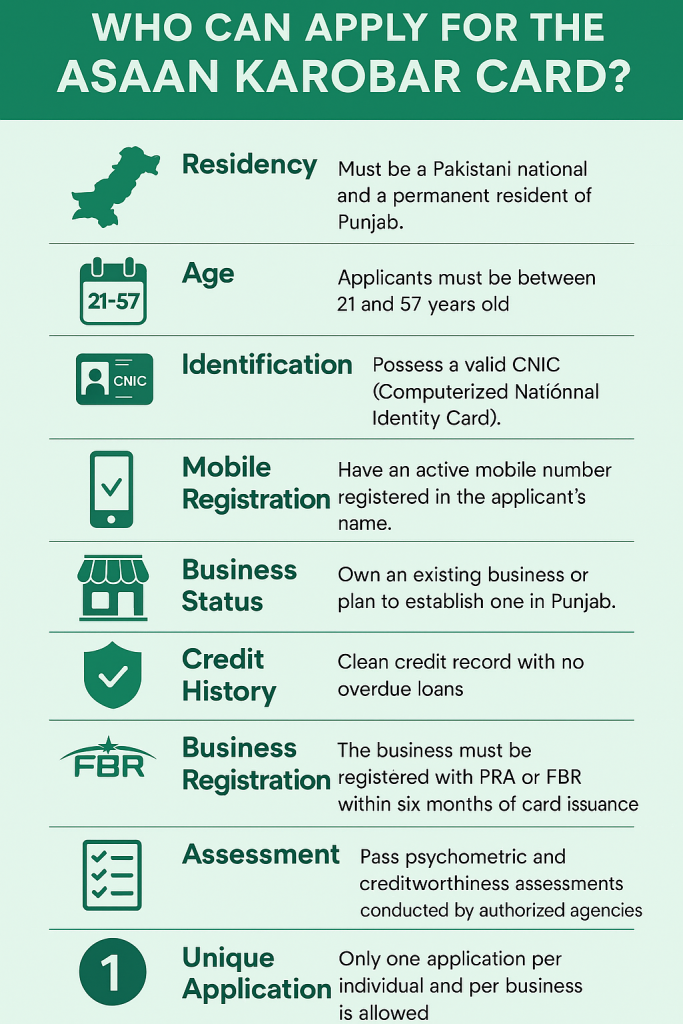

Eligibility Criteria for Asaan Karobar Card

Before applying, it’s essential to understand the eligibility requirements set by the program. Meeting these criteria increases your chances of approval and ensures the initiative benefits genuine entrepreneurs.

These criteria are designed to ensure that only genuine small business owners, startups, and potential entrepreneurs benefit from the scheme.

Ineligibility Criteria for Asaan Karobar Card

Some applicants may not qualify for the Asaan Karobar Card based on certain disqualifying factors. It is important to be aware of the following ineligibility criteria:

By knowing both the eligibility and ineligibility criteria, applicants can avoid wasting time on unsuccessful applications and focus on meeting the necessary requirements.

How to Apply for the Asaan Karobar Card Through akc.punjab.gov.pk (Step-by-Step Process)

Applying for the Asaan Karobar Card is simple and fully digital. Here is a stepwise guide for a smooth application process:

Step 1: Visit the Official Portal

Go to the official Asaan Karobar Card website: akc.punjab.gov.pk.

Step 2: Start Your Application

On the homepage, click on the option for “Apply Now” or “Register.”

Step 3: Fill Out the Online Application Form

- Personal Details: Enter your full name, CNIC number, date of birth, father’s/husband’s name, CNIC issuance and expiry dates.

- Contact Details: Provide your active mobile number and select the mobile network.

- Business Information: Specify whether you own a business or plan to start one, and provide business location details in Punjab.

- Upload Documents: Attach scanned copies of your CNIC and proof of business address or business plan.

Step 4: Pay the Processing Fee

- Pay a non-refundable processing fee of PKR 500 online as per the portal instructions.

Step 5: Submit Your Application

- Double-check all information for accuracy.

- Click the “Submit” button to complete your application.

Step 6: Wait for Digital Verification

- Your CNIC, business details, and creditworthiness will be verified digitally by authorized agencies.

- You may be contacted for additional verification if required.

Step 7: Approval and Card Issuance

- Once approved, you’ll receive an SMS or phone call notification.

- Your Asaan Karobar Card (Business ATM Card) can be collected from the Bank of Punjab or delivered through TCS courier.

Note: Keep your mobile number active to receive timely updates and notifications about your application status.

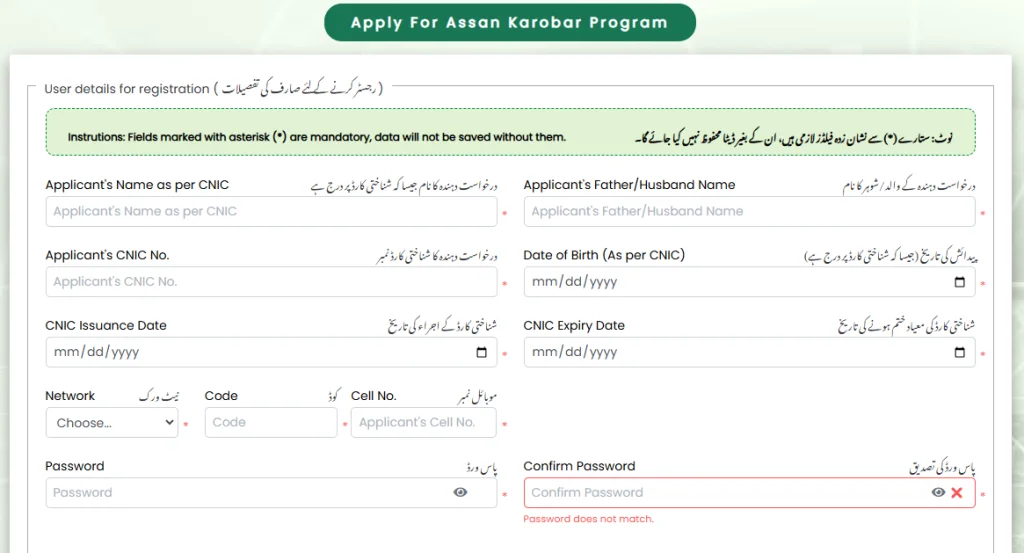

How to Register or Login on the Portal (Step-by-Step Guide)

The registration and login process on the akc.punjab.gov.pk portal is straightforward. Here’s how you can get started:

Registration Process

Step 1: Access the Registration Page

- Go to akc.punjab.gov.pk and click on “Register Now.”

Step 2: Enter Your Personal Information

- Fill in your full name as per your CNIC.

- Enter your CNIC number and date of birth.

- Provide your father’s or husband’s name.

- Enter the issuance and expiry dates of your CNIC.

Step 3: Add Contact Details

- Provide a valid and active mobile number.

- Select your mobile network.

Step 4: Set Up Account Security

- Create a secure password and confirm it.

Step 5: Complete Registration

- Review all entered details for accuracy.

- Click the “Register” button.

- You will receive a confirmation SMS upon successful registration.

Login Process

Step 1: Access the Login Page

- Return to the akc.punjab.gov.pk portal and click on the “Login” option.

Step 2: Enter Your Credentials

- Input your CNIC number and password.

Step 3: Access Your Dashboard

- Click “Login” to enter your dashboard.

- Here, you can track your application, update documents, and check card status.

Tip: Keep your login credentials secure and do not share your password with anyone.

Loan Usage and Repayment Details

Understanding how you can use the Asaan Karobar Card and repay the loan is vital for efficient business management. Here are the key points:

Loan Usage

Restrictions: Funds cannot be used for personal expenses, entertainment, or non-business activities.

Repayment Terms

Timely repayments are crucial to avoid penalties and maintain a clean credit history.

Card Fees and Charges

To keep the program sustainable, the Asaan Karobar Card has a few associated charges:

These minimal charges help cover the administrative costs of the program while ensuring that the maximum benefit goes to small business owners.

How to Track Your Application and Check Status

After applying, you may want to monitor your application status. Here’s how you can do it:

Online Portal

- Log in to your account at akc.punjab.gov.pk.

- Check the dashboard for real-time updates: “Under Review,” “Approved,” or “Pending Documents.”

- If documents are missing, upload them directly in the “Uploads” section.

SMS Service

- Send an SMS: “STATUS [Application ID]” to 8300.

- You’ll receive an instant update on your application status.

Helpline

- Call 051-9053333 (toll-free in Pakistan) or +92-51-9053333 (international).

- Provide your reference number to get live support and status updates.

In-Person Inquiry

- Visit any Bank of Punjab or National Bank of Pakistan branch with your CNIC.

- Ask the staff to check your application status.

Tip: Always keep your records and reference numbers safe for easy tracking.

Key Features of the Asaan Karobar Card

The Asaan Karobar Card is designed with several user-friendly features to support small businesses:

These features make the card a practical and accessible financial tool for thousands of small business owners.

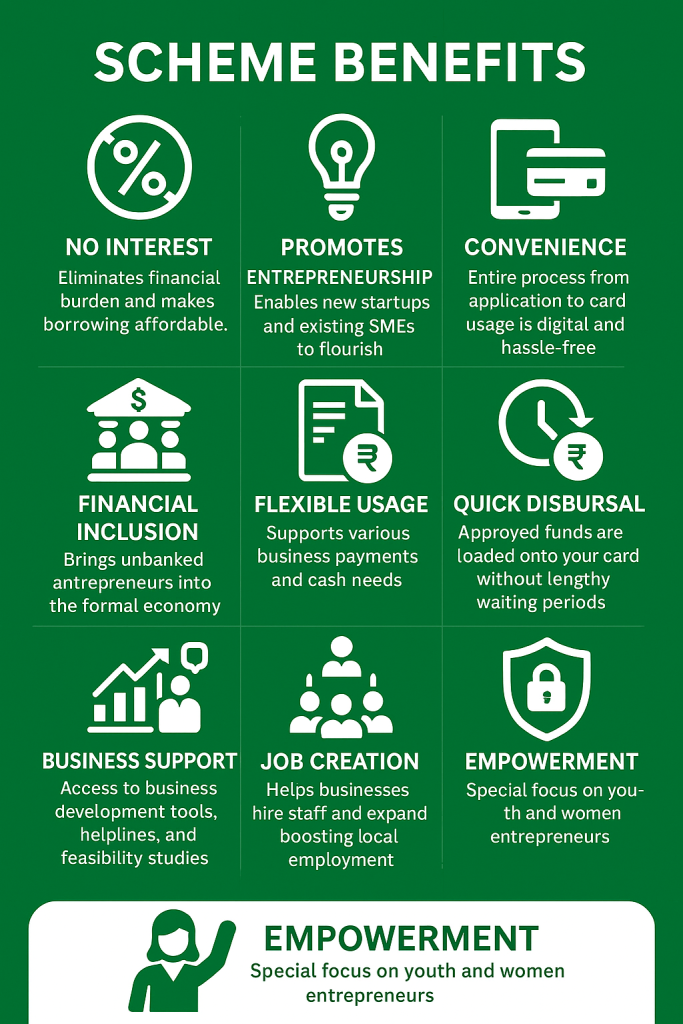

Benefits of the Asaan Karobar Card

The scheme offers multiple benefits that help small businesses grow and succeed:

Security Details

Security and transparency are at the heart of the Asaan Karobar Card initiative:

These security features ensure a safe borrowing environment for all cardholders.

Helpline for Asaan Karobar Card

For any questions or support related to the Asaan Karobar Card, you can contact the official helpline:

- Helpline Number: 1786

- Support: Guidance on application, eligibility, card usage, and troubleshooting.

- Working Hours: Available during standard business hours.

Website: Visit https://akc.punjab.gov.pk for more details and FAQs.

Conclusion

The Asaan Karobar Card is a flagship initiative by the Punjab Government to uplift the province’s small businesses and entrepreneurs. By offering interest-free loans up to PKR 1 million, digital convenience, flexible repayment, and robust security, the scheme breaks down financial barriers and creates opportunities for growth, job creation, and economic development. With a strong commitment to transparency and support, the program is transforming the business landscape of Punjab. If you are an aspiring or existing entrepreneur in Punjab, take advantage of this remarkable opportunity and apply online through akc.punjab.gov.pk today.