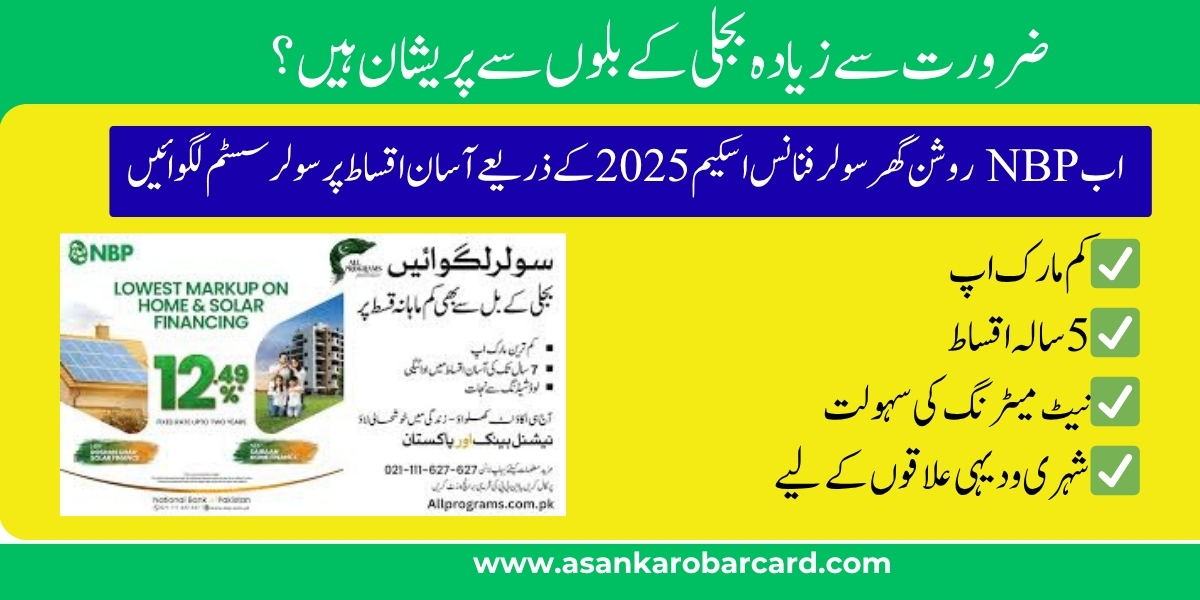

NBP Roshan Ghar Solar Finance Scheme 2025 – Apply Now for Solar Panel Financing in Pakistan

Meta Description:

Discover the NBP Roshan Ghar Solar Finance Scheme 2025. Learn how to apply, eligibility criteria, required documents, and benefits of switching to solar energy through NBP’s green financing initiative.

Introduction to NBP Roshan Ghar Solar Finance Scheme 2025

The NBP Roshan Ghar Solar Finance Scheme 2025 is a new initiative by the National Bank of Pakistan (NBP) to support clean and renewable energy adoption in the country. This scheme allows households and small businesses to finance solar panel systems through easy monthly installments with low markup rates.

With rising electricity costs and frequent power outages, many families in Pakistan are turning to solar power. NBP’s Roshan Ghar Scheme makes it easier than ever to go solar without upfront financial stress.

Objective of NBP Roshan Ghar Solar Finance Scheme 2025

The main aim of this scheme is to:

- Promote renewable and sustainable energy in Pakistan.

- Reduce electricity bills for households and small businesses.

- Provide easy financing options for solar panel installation.

- Support the government’s green energy goals.

The Roshan Ghar Scheme 2025 empowers citizens to produce their own electricity and save money in the long run.

Eligibility Criteria for NBP Roshan Ghar Scheme 2025

To apply for this scheme, you must meet the following conditions:

- Pakistani national with valid CNIC

- Salaried person, business owner, or pensioner with stable income

- Must have ownership or legal residency rights of the property

- Good credit history with no default record

- Solar system capacity between 1 KW to 10 KW

Both urban and rural areas are eligible under this scheme.

Required Documents for Roshan Ghar Solar Finance

Make sure to prepare these documents before applying:

- CNIC Copy (of applicant and co-applicant, if any)

- Latest Utility Bill (Electricity)

- Proof of Income (Salary Slip, Pension Book, or Bank Statement for business owners)

- Ownership Proof of the house or permission letter from the owner

- Two Passport Size Photos

- Quotation from PEC or AEDB certified vendor

- Filled Application Form (available at NBP branches)

How to Apply for NBP Roshan Ghar Solar Finance Scheme 2025

Follow these simple steps to apply for the solar finance scheme:

Step 1: Visit Nearest NBP Branch

Go to your nearest NBP branch and ask for the Roshan Ghar Solar Finance Form.

Step 2: Submit Required Documents

Attach all required documents with the application form.

Step 3: Vendor Verification

Choose a PEC or AEDB certified solar vendor. NBP will verify the quotation and system design.

Step 4: Application Review

NBP will evaluate your credit score and financial eligibility.

Step 5: Loan Approval & Disbursement

Once approved, the loan amount will be paid directly to the solar vendor.

Step 6: Installation & Net Metering

The solar panels will be installed at your home. Net metering setup may also be arranged.

FAQs about NBP Roshan Ghar Solar Finance Scheme 2025

Q1: What is the maximum loan amount I can get?

Answer: You can get financing up to Rs. 2 million, depending on system size and income.

Q2: What is the markup rate?

Answer: The markup rate is competitive and subsidized, typically starting from 6% annually under green finance initiatives.

Q3: Can I choose any solar vendor?

Answer: No. You must choose a vendor that is certified by AEDB or PEC.

Q4: Is net metering included in the scheme?

Answer: Yes, you can apply for net metering after solar panel installation.

Q5: What is the repayment period?

Answer: You can choose a repayment period of 1 to 5 years with monthly installments.

Q6: Can a tenant apply for this scheme?

Answer: Yes, with permission from the property owner and proper documentation.

Q7: Is this scheme available across Pakistan?

Answer: Yes, the scheme is available nationwide through NBP branches.

Final Thoughts

The NBP Roshan Ghar Solar Finance Scheme 2025 is a smart and eco-friendly way to take control of your electricity needs. With flexible financing, reduced electricity bills, and support for a greener Pakistan, this scheme is ideal for families and small businesses looking to invest in solar energy.

Apply today and brighten your future with Roshan Ghar!

Let me know if you’d like a social media post, infographic image, or Urdu version of this content.

SEO Optimized Article

Title: NBP Roshan Ghar Solar Finance Scheme 2025 – Apply Now for Solar Panel Financing in Pakistan

Meta Description:

Discover the NBP Roshan Ghar Solar Finance Scheme 2025. Learn how to apply, eligibility criteria, required documents, and benefits of switching to solar energy through NBP’s green financing initiative.

Slug: nbp-roshan-ghar-solar-finance-scheme-2025

Introduction to NBP Roshan Ghar Solar Finance Scheme 2025

The NBP Roshan Ghar Solar Finance Scheme 2025 is a new initiative by the National Bank of Pakistan (NBP) to support clean and renewable energy adoption in the country. This scheme allows households and small businesses to finance solar panel systems through easy monthly installments with low markup rates.

With rising electricity costs and frequent power outages, many families in Pakistan are turning to solar power. NBP’s Roshan Ghar Scheme makes it easier than ever to go solar without upfront financial stress.

Objective of NBP Roshan Ghar Solar Finance Scheme 2025

The main aim of this scheme is to:

- Promote renewable and sustainable energy in Pakistan.

- Reduce electricity bills for households and small businesses.

- Provide easy financing options for solar panel installation.

- Support the government’s green energy goals.

The Roshan Ghar Scheme 2025 empowers citizens to produce their own electricity and save money in the long run.

Eligibility Criteria for NBP Roshan Ghar Scheme 2025

To apply for this scheme, you must meet the following conditions:

- Pakistani national with valid CNIC

- Salaried person, business owner, or pensioner with stable income

- Must have ownership or legal residency rights of the property

- Good credit history with no default record

- Solar system capacity between 1 KW to 10 KW

Both urban and rural areas are eligible under this scheme.

Required Documents for Roshan Ghar Solar Finance

Make sure to prepare these documents before applying:

- CNIC Copy (of applicant and co-applicant, if any)

- Latest Utility Bill (Electricity)

- Proof of Income (Salary Slip, Pension Book, or Bank Statement for business owners)

- Ownership Proof of the house or permission letter from the owner

- Two Passport Size Photos

- Quotation from PEC or AEDB certified vendor

- Filled Application Form (available at NBP branches)

How to Apply for NBP Roshan Ghar Solar Finance Scheme 2025

Follow these simple steps to apply for the solar finance scheme:

Step 1: Visit Nearest NBP Branch

Go to your nearest NBP branch and ask for the Roshan Ghar Solar Finance Form.

Step 2: Submit Required Documents

Attach all required documents with the application form.

Step 3: Vendor Verification

Choose a PEC or AEDB certified solar vendor. NBP will verify the quotation and system design.

Step 4: Application Review

NBP will evaluate your credit score and financial eligibility.

Step 5: Loan Approval & Disbursement

Once approved, the loan amount will be paid directly to the solar vendor.

Step 6: Installation & Net Metering

The solar panels will be installed at your home. Net metering setup may also be arranged.

FAQs about NBP Roshan Ghar Solar Finance Scheme 2025

Q1: What is the maximum loan amount I can get?

Answer: You can get financing up to Rs. 2 million, depending on system size and income.

Q2: What is the markup rate?

Answer: The markup rate is competitive and subsidized, typically starting from 6% annually under green finance initiatives.

Q3: Can I choose any solar vendor?

Answer: No. You must choose a vendor that is certified by AEDB or PEC.

Q4: Is net metering included in the scheme?

Answer: Yes, you can apply for net metering after solar panel installation.

Q5: What is the repayment period?

Answer: You can choose a repayment period of 1 to 5 years with monthly installments.

Q6: Can a tenant apply for this scheme?

Answer: Yes, with permission from the property owner and proper documentation.

Q7: Is this scheme available across Pakistan?

Answer: Yes, the scheme is available nationwide through NBP branches.

Final Thoughts

The NBP Roshan Ghar Solar Finance Scheme 2025 is a smart and eco-friendly way to take control of your electricity needs. With flexible financing, reduced electricity bills, and support for a greener Pakistan, this scheme is ideal for families and small businesses looking to invest in solar energy.

Apply today and brighten your future with Roshan Ghar!