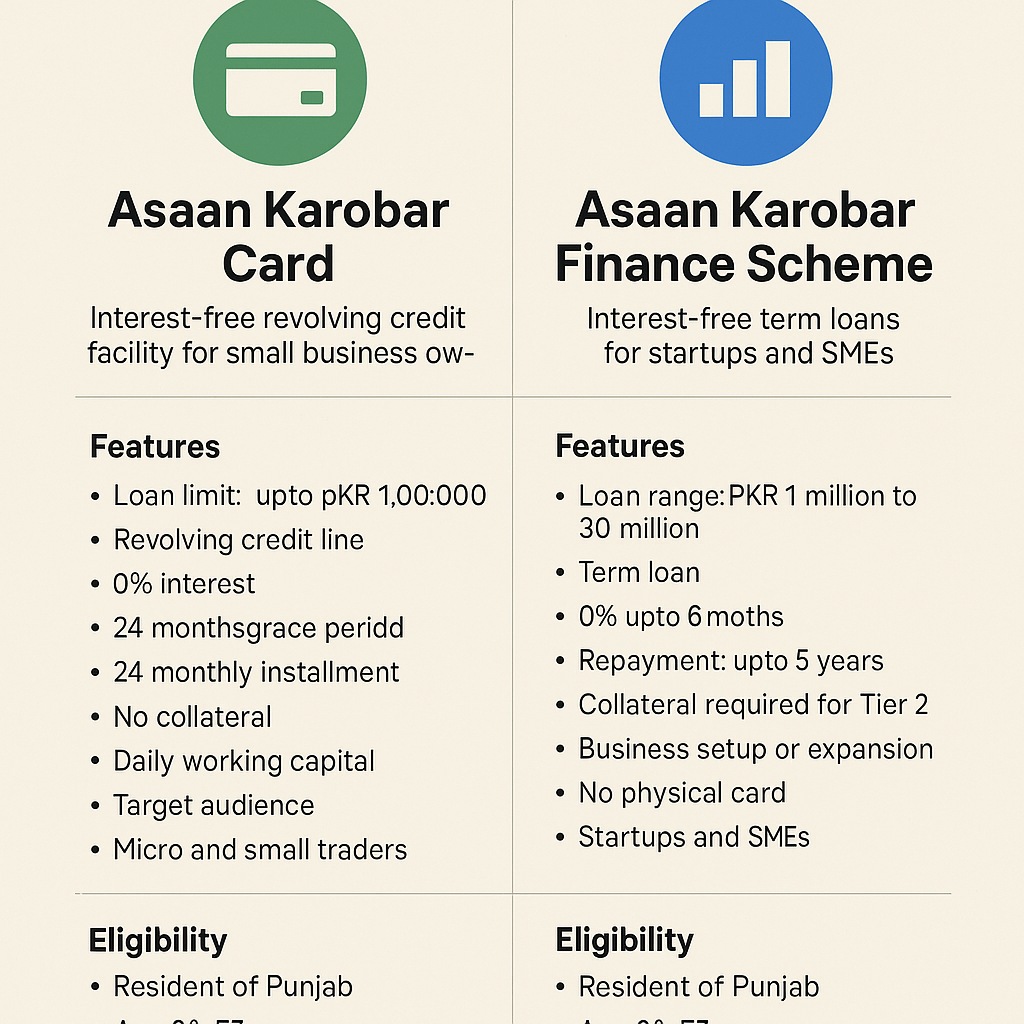

Difference Between Asaan Karobar Card and Asaan Karobar Finance Scheme

In 2025, the Punjab government launched two major programs to support small businesses: Asaan Karobar Card and Asaan Karobar Finance Scheme. While both are designed to uplift small and medium enterprises (SMEs) by providing financial help, they are two separate initiatives with different features, purposes, and benefits.

Unfortunately, many people confuse these schemes, thinking they are the same. In this article, we will explain both schemes clearly and highlight the key differences between them.

What is Asaan Karobar Card?

The Asaan Karobar Card is an interest-free revolving credit facility offered to small business owners in Punjab. It is designed to provide easy and quick working capital for everyday business needs such as buying stock, paying bills, or covering short-term expenses.

Key Features:

- Loan limit: Up to PKR 1,000,000

- Type: Revolving credit line

- Interest: 0%

- Repayment:

- First 12 months: Use as needed

- Next 24 months: Pay in equal monthly installments

- Grace period: 3 months

- Cash withdrawal: Up to 25% of the limit allowed

- Card issued: A physical card is provided to make payments or withdrawals

Benefits:

- No interest charges

- Useful for small traders, shopkeepers, and street vendors

- Encourages digital transactions

- Can be reused after repayment

Eligibility Criteria:

- Must be a resident of Punjab

- Age between 21 to 57 years

- Valid CNIC and mobile number registered on CNIC

- Business must be active in Punjab

- Must have a clean credit history

- Only one card per individual or business

What is Asaan Karobar Finance Scheme?

The Asaan Karobar Finance Scheme is a larger financial program that provides interest-free term loans to startups and SMEs for business expansion, equipment, or working capital. It supports existing businesses and new entrepreneurs with higher loan limits.

Key Features:

- Loan range: PKR 1 million to 30 million

- Type: Term loan (not revolving)

- Interest: 0%

- Tenure: Up to 5 years

- Grace period: Up to 6 months (startups), 3 months (existing businesses)

- Tiers:

- Tier 1: 1 to 5 million (no collateral)

- Tier 2: 6 to 30 million (collateral required)

Benefits:

- Suitable for business expansion or startup investment

- Large loan amounts

- No interest burden

- Discounts for women, transgender, and differently-abled

- Eco-friendly projects receive special benefits

Eligibility Criteria:

- Age between 21 to 57 years

- Resident of Punjab

- Active FBR filer

- Clean credit history

- Must be a Pakistani national

- Business must be registered or operational in Punjab

- Must have necessary business documents

Comparison Table

| Feature | Asaan Karobar Card | Asaan Karobar Finance Scheme |

|---|---|---|

| Loan Amount | Up to PKR 1 million | PKR 1 million to 30 million |

| Type | Revolving credit | Term loan |

| Interest | 0% | 0% |

| Grace Period | 3 months | Up to 6 months |

| Repayment | 24 monthly installments | Up to 5 years |

| Collateral | Not required | Required for Tier 2 |

| Purpose | Daily working capital | Business setup or expansion |

| Card Issued | Yes | No |

| Target Audience | Micro and small traders | Startups and SMEs |

| Processing Fee | Minimal | PKR 5,000 – 10,000 (based on tier) |

Summary

Both schemes aim to boost entrepreneurship and economic activity in Punjab. However, they are meant for different levels of businesses.

- Asaan Karobar Card is best for small shopkeepers and daily traders.

- Asaan Karobar Finance Scheme is designed for larger SMEs or startups needing major financial investment.

It is important for applicants to understand these differences before applying.

Also Check: Asaan Karobar Card Online Registration Complete Guide

Conclusion

In conclusion, the Asaan Karobar Card and Asaan Karobar Finance Scheme are both excellent efforts by the Punjab government to support businesses, but they serve different business needs. If you are a small vendor or shopkeeper, the Card may be right for you. If you are launching a startup or growing your SME, then the Finance Scheme is the better choice.

Always read the guidelines, eligibility, and terms carefully before applying. If you’re still unsure, you can contact the helpline 1786 for more details.

Frequently Asked Questions (FAQs)

Q1: Can I apply for both schemes at the same time?

No, you can only apply for one scheme at a time per person or business.

Q2: Do both schemes offer interest-free loans?

Yes, both schemes are completely interest-free.

Q3: Is a physical card issued in both schemes?

Only the Asaan Karobar Card provides a physical card for transactions. The Finance Scheme does not.

Q4: What is the processing fee?

- Asaan Karobar Card: Usually low or no fee

- Finance Scheme: PKR 5,000 to PKR 10,000 depending on tier

Q5: Who verifies the applications?

The Bank of Punjab verifies business details, credit history, and eligibility for both schemes.

Q6: Can women and disabled persons get any special benefits?

Yes, they get equity discounts and other priority benefits under the Finance Scheme.

One Comment