Asaan Karobar Card Online Registration Complete Guide

Starting a small business can be a life-changing opportunity but finances often stand in the way. To support young entrepreneurs and small business owners in Punjab, the government has introduced the Asaan Karobar Card Scheme. This initiative offers interest-free loans of up to PKR 1 million to help individuals launch or expand their businesses.

If you are planning to benefit from this scheme, this guide will help you understand how to register, what documents are needed, and how to complete your application step-by-step. Read on to learn everything you need to know.

What is the Asaan Karobar Card?

The Asaan Karobar Card is part of an economic empowerment program by the Punjab Government. It is aimed at offering financial support without interest, especially to those who have limited access to banks or credit facilities.

Through this card, eligible individuals can access funds for business expenses like purchasing stock, paying utility bills, and managing operational costs.

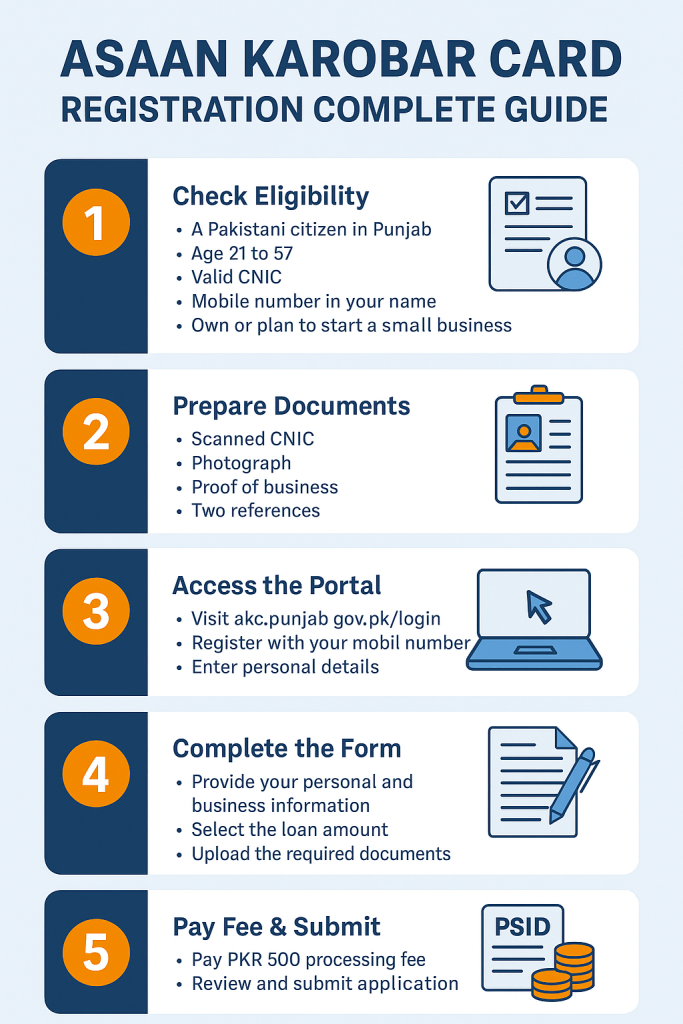

AKC Registration Process Step By Step

Check If You’re Eligible

Before starting the registration, make sure you meet these basic requirements:

- You must be a Pakistani citizen living in Punjab.

- Your age should be between 21 and 57 years.

- A valid CNIC is necessary.

- Your mobile number must be registered in your own name.

- You should either own a small business or have a plan to start one.

- You must have a clean financial record (no unpaid loans).

- Only one application is allowed per person.

If you fit the criteria, you are ready to start the process.

Prepare Your Documents

To make your registration smooth, arrange the following documents in advance:

- Scanned CNIC (both front and back)

- Clear photograph (passport-sized or a recent selfie)

- Business proof (like rent agreement, business registration certificate)

- Two references (non-family members with CNIC and contact numbers)

- Bank statement (optional but helpful for approval)

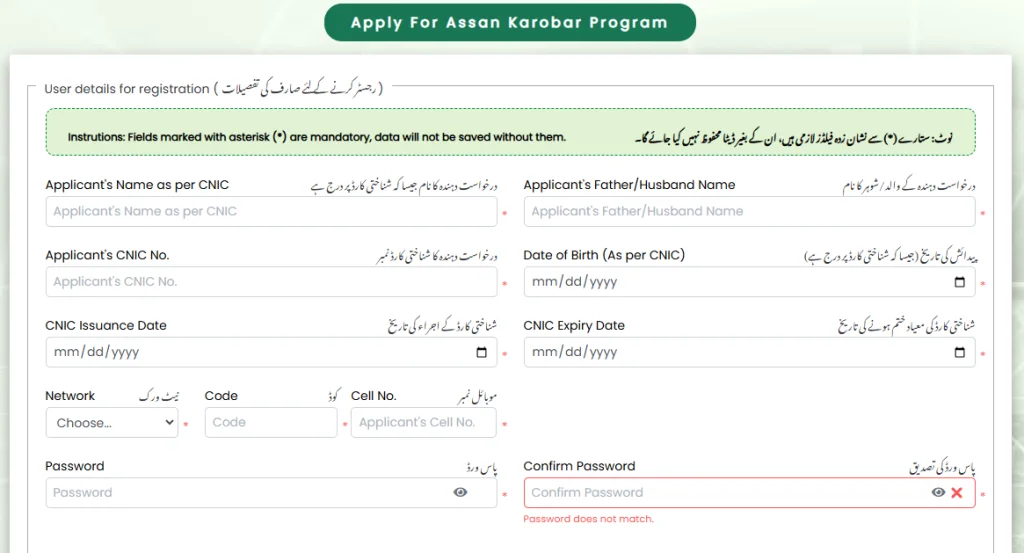

Access the Official Portal

To begin your application:

- Visit the official website: https://akc.punjab.gov.pk/login

- Click on “Register Now”.

- Enter your mobile number (must be in your name).

- Create a strong password (use capital letters, numbers, and special characters).

- Submit your basic details like name, CNIC, father’s name, and date of birth.

Make sure all entries are accurate.

Complete the Online Form

Once you’re registered, log in and fill out the application form:

- Personal Information: Address, city, education, marital status.

- Business Details: Name of business, category, size, start date, and income details.

- Loan Request: Select your loan amount (between PKR 100,000 to PKR 1,000,000).

- Documents Upload: Upload CNIC scans, photo, and business documents.

- References: Provide details of two unrelated people who know you well.

Always click “Save” before moving to the next step.

Processing Fee Payment

After submitting your application, a PSID code (19-digit number) will be generated. This code is used to pay a processing fee of PKR 500.

You can pay this fee through:

- Mobile banking apps (using 1Bill option)

- ATMs of major banks

- Over-the-counter at NBP or BOP branches

Once paid, log in again to confirm that your fee status shows “Paid”.

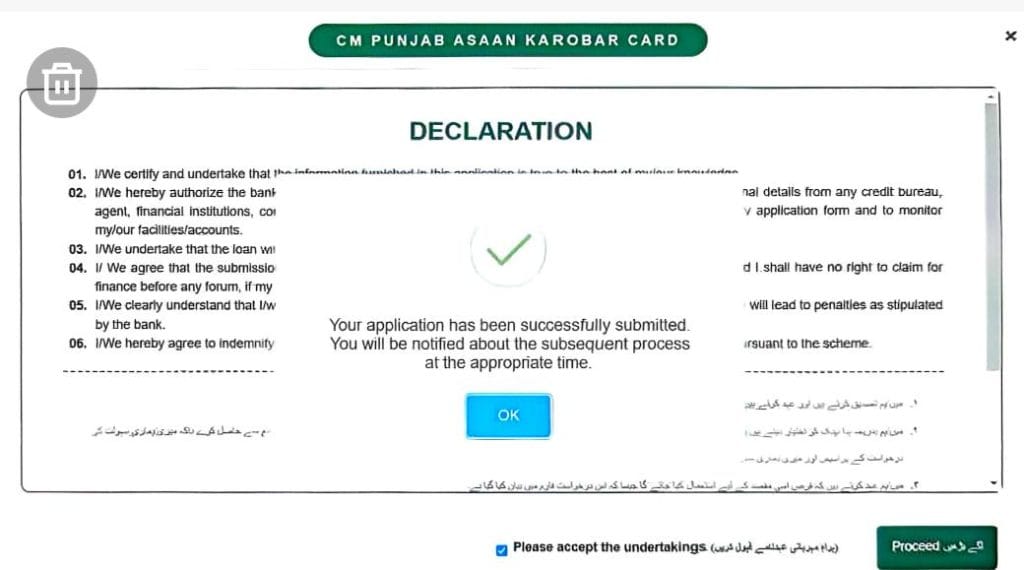

Final Submission

Carefully review all the information. When you’re confident everything is correct, click on “Submit”.

You should receive a confirmation message and application reference number. If you don’t get a message, but the form is no longer editable, it means your application was submitted.

What Happens After Submission?

Your application goes through multiple checks before approval:

- Digital Verification: Confirms your CNIC and mobile registration.

- Credit Review: Assesses your financial behavior and payment history.

- Business Check: Verifies your business location and legitimacy.

- Bank Review: Final approval comes from the Bank of Punjab (BOP).

- Psychometric Test: You might be asked to complete a personality and financial behavior test.

- Physical Visit: Officers may visit your business to ensure operations are as described.

Once approved, your Asaan Karobar Card will be issued and linked with your loan account.

Key Benefits of Asaan Karobar Card

Here are some major advantages of the scheme:

Usage: Covers business payments, utility bills, taxes, and digital transactions

Loan Limit: Up to PKR 1 million

Interest-Free: No markup or hidden charges

Repayment: Start paying after a 3-month grace period

Duration: Payable in 24 monthly installments

Useful Tips for Applicants

- Make sure all information is truthful and updated.

- Use a laptop or desktop for better access to the portal.

- Keep a copy of your application reference number and PSID code.

- Contact helpline 1786 for queries or issues.

Conclusion

The Asaan Karobar Card is a great initiative by the Punjab Government to empower local entrepreneurs. If you meet the criteria, don’t miss this chance to get interest-free financial support for your business. Just follow this step-by-step registration guide to ensure a smooth and successful application.

FAQs

Can I apply from a mobile phone?

You can, but the site works better on a laptop or desktop browser.

What if I enter wrong information?

Incorrect data may lead to rejection. Double-check everything before submission.

Can I edit my form after submission?

No. Once submitted, you cannot make changes.

Do I need to visit a bank physically?

No, the process is fully digital, but physical verification of your business may occur later.

Is being a tax filer important?

It’s not mandatory at the start, but being a filer helps in the long run and saves tax.

Check Also: How to Check Application Status of Asaan Karobar Finance Scheme?

One Comment