Asaan Karobar Card Scheme Registration Opens Again 2025 – Easy Apply

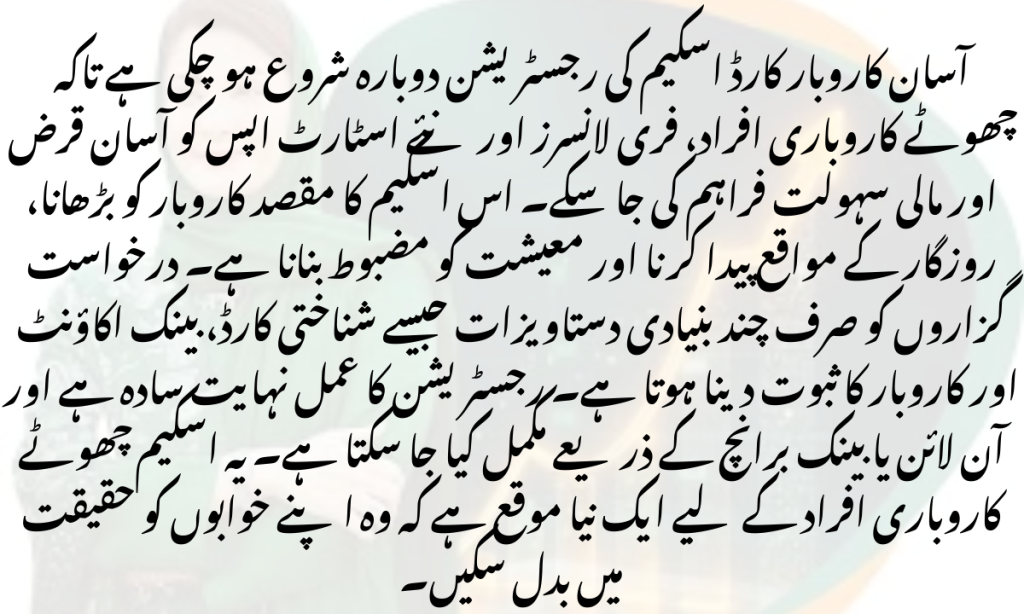

Asaan Karobar Card Scheme Registration Opens Again 2025 Good news for small business owners, freelancers, and entrepreneurs in Pakistan: the registration has opened again. This program is designed to support people who are struggling to grow their businesses or want to start new ones but face financial barriers.

Good news for small business owners, freelancers, and entrepreneurs in Pakistan: the Aasan Karobar Card Scheme registration has opened again. This program is designed to support people who are struggling to grow their businesses or want to start new ones but face financial barriers.

For many, arranging funds to buy equipment, expand shops, or cover running costs feels impossible. Traditional loans are often complicated and require heavy guarantees. The Aasan Karobar Card Scheme offers a simple and supportive way to access funds with easy terms.

If you missed the last registration phase, this is your chance to apply again. Let’s explore what this scheme is, how it works, and how you can benefit from it.

Quick Highlights of the Asaan Card Scheme

| Features | Details |

|---|---|

| Scheme Name | Asaan Karobar Card Scheme |

| Purpose | Easy access to loans for small businesses & entrepreneurs |

| Registration Status | Open again |

| Who Can Apply | Small business owners, freelancers, startups |

| Loan/Limit | Up to Rs. 1,000,000 |

| Repayment | Easy installments, low markup |

| Where to Apply | Official website / Partner banks |

What is the Asaan Karobar Card Scheme?

The Aasan Karobar Card Scheme is a government-backed financial program that provides easy loans and credit support to small businesses and individuals.Its main goal is to encourage entrepreneurship and help people grow their businesses without the fear of high-interest loans or complicated banking procedures.

Think of it as a supportive financial tool. Instead of begging lenders for money, you get access to funds through a structured program designed for people like you.For example, a tailor who needs a new sewing machine, a freelancer who needs a laptop, or a shopkeeper who wants to add more stock , all can benefit from this scheme.

Why Asaan Karobar Card Scheme Registration Opens Again 2025?

The scheme received an overwhelming response in the past. Many people applied, but thousands missed out due to limited time or lack of awareness.Now, the registration has opened again to give a second chance to those who were left behind. It also shows the government’s interest in promoting small businesses and supporting the backbone of the economy.

If you wanted to apply before but couldn’t, now is the right time.

Eligibility Criteria For the Asaan Karobar Card Scheme

The scheme is meant for ordinary people running small businesses. You don’t need to be a big company owner.

Here are the main eligibility points:

- Pakistani citizens with a valid CNIC.

- Small shop owners, stall owners, and service providers.

- Freelancers and self-employed professionals.

- Startups or new entrepreneurs with a business idea.

- Age between 18 and 55 (flexible based on guidelines).

To make it simple:

- If you run a tea stall, you can apply.

- If you sell products online, you can apply.

- If you work as a freelancer, you can apply.

This inclusivity makes the scheme practical for everyday people.

Documents Required for Aasan Card Registration

When applying, you will need some basic documents. Don’t worry—these are not difficult to arrange:

- Valid CNIC copy.

- Proof of business (like a shop license, freelancer profile, or business letter).

- Bank account details.

- Passport-size photograph.

- Income proof (if required).

- Recent utility bill for address verification.

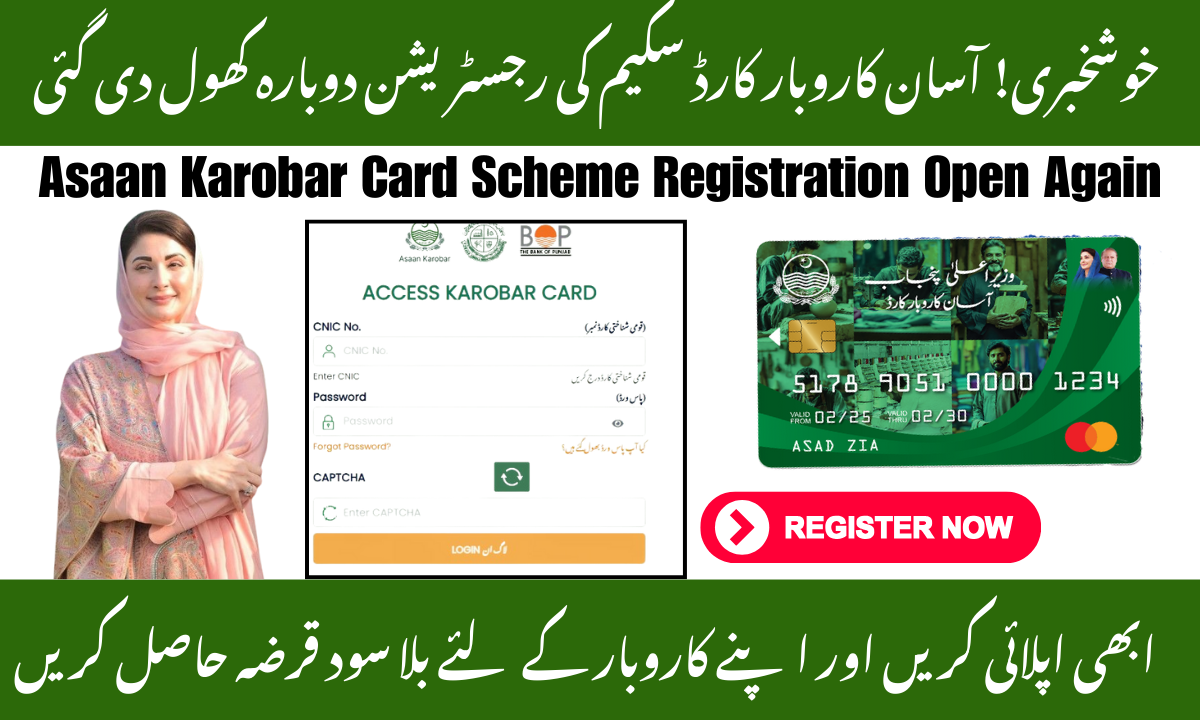

Asaan Karobar Card Scheme Online Registration 2025

The registration process for the Aasan Karobar Card Scheme is designed to be simple and friendly, especially for people who may not be familiar with complicated banking systems. Still, it helps to know each step in detail so you don’t feel lost. Here’s a breakdown:

Step 1: Visit the Official Website or Partner Bank Branch

- If you are comfortable with online applications, go to the official registration website. The portal is usually active when registrations are open.

- If you don’t have internet access or prefer in-person support, you can visit the nearest partner bank branch (banks listed under the scheme). The bank staff can guide you through the process.

Step 2: Fill in the Online Application Form

- Once you’re on the website, look for the registration tab and click “Apply Now.”

- The form will ask for basic details such as:

- Full name (as per CNIC)

- CNIC number and issue date

- Date of birth

- Contact number and email

- Residential and business address

- Type of business (shop, freelance, startup, service, etc.)

- Take your time and fill the form carefully. Even a small spelling mistake in your name or CNIC can cause delays.

Step 3: Upload or Attach Your Documents

- The portal will ask you to upload scanned copies or clear pictures of required documents, such as:

- CNIC (front and back)

- Bank account details (a statement or account book snapshot)

- Proof of business (license, online profile, or a signed declaration)

- Recent photograph

- Utility bill (for address verification)

- If applying through a bank branch, take both original and photocopies of your documents. Staff will verify and keep the required copies.

Step 4: Review and Submit the Application

- After filling the form and attaching documents, carefully review everything. Double-check your CNIC number, phone number, and bank details.

- Click “Submit” if applying online. You should see a confirmation message on your screen.

- If you’re applying at the bank, the officer will enter your details into the system and provide you with a receipt or reference number.

Step 5: Wait for Confirmation and Approval

- After submission, the application goes through verification. Authorities check your CNIC, business proof, and other details.

- If everything is correct, you’ll receive an SMS or email about your application status.

- Some applicants may be contacted by the bank for additional information.

- Once approved, you’ll be informed about when and how you can collect or activate your card.

Key Features and Benefits of Aasan Card

The Aasan Karobar Card Scheme comes with multiple advantages:

- Loan/credit limit: You can borrow up to a certain amount (based on rules).

- Easy repayment: Pay back in small, manageable installments.

- Low markup: Much cheaper compared to traditional bank loans.

- No heavy collateral: Unlike banks, you don’t need property or big guarantees.

- Extra support: Training, digital payment tools, and financial guidance.

Imagine this: you run a small bakery and want to buy a new oven. With this scheme, you don’t need to save for years. You can buy the oven now, grow your sales, and repay gradually.

This is why the scheme feels like a lifeline for small businesses.

Common Issues & Troubleshooting Asan Karobar Card

Like any process, you may face small hurdles. Here are common issues and quick fixes:

- Website not opening: Try again during non-peak hours or from a different browser.

- Missing documents: Make a checklist before starting the application.

- Eligibility confusion: Call the helpline or visit a nearby bank.

- Application rejection: Don’t panic. Understand the reason and reapply with corrections.

Why This Scheme Matters for Pakistan’s Economy

Small businesses are the backbone of Pakistan’s economy. They create jobs, provide services, and keep local markets alive.By supporting small entrepreneurs, this scheme strengthens the economy from the ground up. It reduces dependency on informal moneylenders and promotes formal banking.When small businesses grow, they not only support their own families but also provide employment to others. That’s why schemes like this matter so much.

Final Thoughts

The reopening of the Aasan Karobar Card Scheme registration is a golden opportunity.If you are running a small business, freelancing, or planning to start something new—this is your chance. Don’t wait too long, as registrations may close again once the quota is full.Remember, this scheme is more than financial support. It is a chance to turn dreams into reality. Take the step, register today, and invest in your future.